tv Nightly Business Report PBS August 20, 2013 6:30pm-7:01pm PDT

6:30 pm

. this is "nightly business report" with tyler mathisen and susie gharib brought to you by. >> sailing through the heart of historic cities and saland skip on a river, you get close to iconic landmarks, to local life, to cultural treasures. viking river cruises, exploring the world in comfort. and a come back, best buy seemingly did it turning sharp losses into big profits. what went right at best buy and what can limping j.c. penney and barnes & noble learn from it? >> crunch time. six weeks until open enrollment but with privacy issues and an add war breaking out, will new health exchanges be up and

6:31 pm

running. and risky business unregulated banking is a 6 trillion dollar industry in china. it could cripple the world's second largest economy. that and more tonight on "nightly business report" for tuesday, august 20th. good evening everyone. the big buzz on wall street today, the strength of the american consumer. four retailers came out with earnings and the results are mixed raising questions about how comfortable consumers are about spending and how that could impact the u.s. economy. first up, home depot. sales soared 11% helped by the turn around in housing. sales are so good they uplifted the sales and earning look for the rest of the year. barnes & noble doubled, hurt by a 20% drop in sales by the nook e reader. j.c. penney lasts tripled and sales dropped 11% as it tries to recover from sales strategies of the past.

6:32 pm

the biggest surprise is from best buy, earnings up a stunning 22 times from a year ago. it looks like the electronics giant once left for dead enga neared a turn around that could be the envy of the sector. courtney regan has more on the comeback. >> reporter: this is the type of shopper best buy is trying to attract. the kind that's willing to come into the store and spend money. >> there is usually quite a lot to choose from and if you can't find it here, it's online. >> reporter: for years they company to bring in paying customers. best buy was the place for shoppers to showroom or preview an extensive tv or computer before buying it at cheaper prices at amazon or walmart but today investors got signs the company may be finding it's way to profitability. >> best buy in the early innings is a multi-year turn around. >> reporter: the earnings are much stronger posting a profit for the first time in a year.

6:33 pm

it's stock jumped another 10% on the news. shares are up better than 185% on the year, easily making it one of wall street's strongest performers. part of best buy's recent success is keeping consumers from turning elsewhere. >> they have a price match policy and being aggressive on driving improved conversion rate at the store level. those factors drive better sales results in the coming quarters. >> reporter: but price matching isn't the only thing driving the drive around. they are focussed on cutting costs and revamping others for more efficient use of floor space. online sales once seen as a major contributor to the demise of brick and mortar, are a surprising spot for best buy. there is revenue of 477 million for the quarter, a 10% increase. the company has been building out it's store within a store models. bringing in many samsung and

6:34 pm

microsoft stores complete with samsung and microsoft products and experts under the familiar blue roof. best buy is doing what it said it would when it laid out the strategy in november making measured improvements and leveraging strength focused around the consumers changing needs. perhaps struggling retailers j.c. penney and barnes & noble should take note. it's part of the ceo's efforts to make best buy for inviting for customers telling me earlier today we wanted less about measuring the temperature of the consumer. we know they are looking for value and a positive experience. we focus on what we can do to provide compelling offers and service. with best buy shares at a two-year high, investors hope that service is compelling enough to keep shoppers coming through the door. well, on wall street not even those kind of sort of better than expected retail

6:35 pm

earnings could stop the dow from falling for a fifth straight session, even if the loss today was modest. one dow stock in the spotlight, exxonmobil lost ground in the 19 of the past 20 sessions. the dow down 20 points but closing above 15,000, just barely. the nasdaq was up 24 points thanks to the strength of txdot and the s&p 500 added six. emerging markets struggled with higher treasury yields to drive investors into the dollar and that sucked money into a host of foreign currencies in asia. today the indian roopie tumbled. those tumbling currencies and stocks thousands of miles away from wall street are the latest worry for american investors. joining us to talk about why, chief market strike thattest. nick, nice to have you on the program again. let me ask you why are american

6:36 pm

investors worried about the emerging markets and sale justioffs? connect the dots. >> sure, two factors play. the first is emerging markets fast growth with young economies that are really right for a big step function increase in gdp growth and consumption and that growth is really tempered around the world, the classic brick countries, brazil, russia, china aren't growing as fast. the smaller countries that you eluded to in the prior segment might have small and growing economies but they are fragile economies. when you see this volatility in currencies, people take notice. >> nick, is this a short-term sell off or something more enduring? >> it feels more enduring than this week or next and the reason for that is the uncertainty behind the federal reserve policy of tapering or reducing the amount of bonds they purchase every week. as long as we're uncertain about

6:37 pm

the path, we'll see the volatility in currency markets and that will lead to what you seen in equity markets, as well it was interesting listening to chatter about this today on wall street. there were some strategist saying some of the money they have invested in those countries will be coming into u.s. that will be good for u.s. markets. other strategist talking about a possible financial crisis as a result of all of this, the asian crisis of 1998. do you agree with that? what should investors do? >> on the second point it's too early to panic and worry about an asia crisis from '97, 9 8. some ripples are there but we're far from it, so take that off the table for now. it's a wait and see attitude in equities around the world. they appreciate the fact the u.s. market rallied and a great

6:38 pm

place to invest but with gains we had over the past one, two, three and four years, clients are hesitant to put fresh money to work here. they want to see the tapering market in the near term. >> compare the prospects over let's say the next two years for equity investors in u.s. stocks versus the emerging markets. does the u.s. have the edge now? >> it feels very much that the u.s. has the edge. not only a slowly growing economy but benefits of a larger and established economy. like the rule of law and very consistent trade policy and other factors that make investors comfortable in u.s. stocks. for the near term, it does very much seem like u.s. stocks have the upper hand over emerging markets with the promise of better growth over seas. >> so are you saying bad news in the international market social security actu security -- markets is good news? >> for the year, actually, emerging markets are down 13

6:39 pm

percent, u.s. up 15 percent. the numbers aren't there. over the five years emerging markets have begun to do better and investors are taking notice. so perhaps we're seeing a little turn there. >> nick, thank you so much for coming on the program. >> thank you. >> chief market strategist. president obama hosting a meeting with the national security team at the white house to discuss the deadly unrest in egypt and review the 1.5 billion in u.s. annual aid aide that goes to the military. earlier a white house spokesperson had to refute that the u.s. cut off aid to cairo. another day, another investigation into jp morgan chase. this time the justice department is looking into allegations that bank employees manipulated u.s. energy markets. last month the bank agreed to pay $410 million to settle charges from the federal agency regulatory commission it ma nip laled markets in california and

6:40 pm

the midwest but never admitted wrongdoing as part of the settlement. that prompted the u.s. attorney in new york's southern district to look at the company's energy practices for civil or criminal charges. a passing grade for a for profit provider. the federal department of education shows the company remains financially sound enough to participate in student aid programs without any other qualifications. shares up 11.5% today. no matter where you go to college, the price of getting a degree keeps going up, and so does the amount of federal financial aid students are receiving. scott cohn takes a closer look how many more graduates, under graduates are getting some form of aid and where the money is coming from. >> reporter: at iona college, a small school 15 miles outside new york city, they are putting final touches on campus ahead of

6:41 pm

the fall semester next week and he is putting the final touches on his registration, including financial aid. >> when gave me large package, we didn't discuss it. i accepted iona's offer. >> reporter: virtually his entire bill, around $46,000 for tuition, room and bored is covered by grants, loans, work study and loans his mother took out. >> unless we have financial aid, he wouldn't have been able to make it to college. >> reporter: according to the latest government figures, 71% of under graduates receive some form of college aid in the 2011/2012 school year and for the first time more than half, 57% got at least some of their aid from the federal government. in part, it's because there is more federal money to be had. pell grants and loans are up under the obama administration but there is more to it than that. it's a basic squeeze. tuition keeps rising, state

6:42 pm

support for higher education keeps falling and private money is stagnant. that means for most students, a college education simply isn't affordable without some federal help. in the association of student financial aid administrators say that's unlikely to change any time soon when they rely on tuition for funding. >> the federal government put in funds but haven't kept pace with that disinvestment over the last 40 years. >> reporter: iona increased the aid budget to help bridge the gap. brandon lara hopes in the end it will pay off. >> at some point, way down the road, there is a return on that. >> reporter: but if he or his fellow students are wrong, some of the risk, now more than ever falls on federal taxpayers. for "nightly business report," i'm scott cohn in new york. still ahead, six weeks until open enrollment for healthcare but there are still some major head winds that could prevent

6:43 pm

the exchanges from being open for business. first, a look how the international markets closed today. health insurance cost keep rising, trouble is wastes rges keeping up. kizer found the average cost for family health insurance rose 4% this year but that's double, double the average increase in worker pay. so more income is going for health coverage, which means less is available for other expenses. for americans considering getting their healthcare coverage from new state exchanges, part of the affordable care act, there is six weeks to go before those insurance marketplaces are scheduled to be up and running.

6:44 pm

so, how are states getting the word out about those new coverage options? will they be ready in october? and what happens if they are not up to speed? bert bertha coombs takes a look. >> reporter: spreading the word about enrolling. job one is ensuring residents the state's online exchange will be ready. >> we're tested every week. new elements, not only what we do but how do we relate to the federal hub and the tests are going well. >> reporter: the federal hub is the obama's clearing house that will connect state online marketplaces to systems at irs and the center for medicare and medicaid. for applicant income verification and eligibility for subsides. but according to an inspector general report, the hub's final security certification won't happen until the day before exchanges are due to open. >> it's cutting the margin

6:45 pm

close. if it does actually come through on september 30th, there would be no problem. the next day they would be open for enrollment. the problem would come if it went past that deadline. >> obama officials made progress on the hub and will be ready. if not, lee says california will delay online enrollment. >> we wopt go live if we can't ensure secure information. >> reporter: they will start with paper, if need be, and others are planning to do the same. >> in talking with many players across the country, health insurance plans, states, advocacy groups, they are putting in place these contingency plans for paper enrollment. partly, it's because of concern that maybe all of the systems won't be working properly on day one. >> reporter: if the online exchanges can't launch on time, it could become a major pr problem for the state and obama administration because as they prepare to reach a massive media

6:46 pm

out reach this fall, opponent haves a counter offense. the heritage foundation announced a $500,000 campaign to overturn so-called obamacare. >> there will be political advertising about the law, mainly negative, at the same time insurers and state exchanges and the government are trying to sell it. >> reporter: it has insurers offering plans on the exchanges treading carefully. but if enroll mment proves popular, that could change. >> this is traditionally only spending somewhere around $600 million in every medium, now could suddenly be a billion-dollar category. >> reporter: california plans a slow roll out of it's 85 million dollar adam pain that builds in late fall. >> we need to have a constant drum beat of the facts. >> reporter: because it's not october 1st, but the numbers come january when coverage starts that really count. for "nightly business report,"

6:47 pm

i'm bertha coombs. tomorrow, what is being done to get younger americans enroll enrolled, a critical component. for more about exchanges, go to nbr.com. we begin the market focus tonight with more retail earnings. shares of tjx soaring after they beat the street estimates. the parent of tjmaxx, home goods, marshalls said traffic is up and people are spending more. the stock rose almost 7% to $15.26. urban outfitters a bright spot, sharply higher after a rise in second-quarter profit that bucked the trend as fewer discounts helped margins there. it finished to $43.19 but send sg less on camping and sporting year and prompted dicks to slash the earnings. they said wet and cool conditions discouraged outdoor

6:48 pm

activity weighing on sales of camping and biking equipment in the most recent quarter, the stock is $46.64 the close. netflix with another deal this time with the wine stein company. the subscription for wine stein movies, the studios movies included "the artist," and "the kings." it will start in 2016. the stock rose more than 5% to $273.39, making it the best-performing stock this year. despite descent quarterly reports, solid growth in emerging markets and reiterated outlook for sales and profit for the fiscal year but the medical equipment maker warned of soft demand for inplantable heart

6:49 pm

defibrillators. it closed at $52.83. chinese solar panel maker trina solar beating expectations. they are easing depen dance on europe. shares soared more than 15% to $7.82. shadow banking, financial intermediaries aren't regulated like banks and in china, these kinds of risky financial transactions are more prevalent than ever now. why regulator s in china should be worried. >> reporter: when you first meet lu, it's hard to believe he's a shadow banker. with experience at a wall street firm, he is working in by shang that matches with small-time investors that want to lend. >> in china people think shadow banking is scary and bad. >> reporter: many find it scary because they fear it could

6:50 pm

threaten china and the world. the unregulated industry has untraditional financing to indirect or off balance sheet loans from banks. >> now that we see banks off loans more and more assets into these hidden channels, it is difficult for anybody, the regulato regulators, us to really know what the positions are of banks or borrowers and it's an important part the market is missing. an increasingly large share of the picture of what is going on in china is happening in this black box. >> reporter: this investment trust officer knows what is happening. she agreed to be interviewed if we masked her identity. >> translator: 70% of the business is shadow banking. the banks change the property so the bad debts stay sharp on the balance sheets. >> reporter: investment trust

6:51 pm

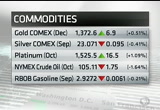

companies are less regulated and sell high-return wealth management products based on riskier investments. >> we're very afraid of the risk. it won't be that risky unless the economy runs into trouble. >> reporter: that is what this banker is worried about. >> i feel at some point the bubble will burst and we'll see a systematic financial crisis like what occur in america in 2008. >> reporter: with china in one of the biggest credit booms in history. and coming up on the program, want to know if more americans are feeling optimistic about the economy? you may find the answer on the road to this labor day weekend. we'll explain. first a check how commodities, currencies and treasuries performed today.

6:52 pm

the tesla electric carp can obviously take a charge and a hit. the sedan is awarded the highest rating ever by the national highway safety administration. every make and model was tested by the agency and the model s with five-star crash rating set a new record for the lowest likelihood of injury to occupants in the event of a crash. there is no gas tank and the rear mounted engine allows for a much longer crumple zone in the front of the car. no matter what car you drive or how safe it is, aaa says that more of us will be hitting the roads this labor day weekend.

6:53 pm

hampton pearson has more on the holiday forecast and what it says about the economy. >> reporter: along the busy i-95 corridor between new york city and virginia and north carolina beaches, travelers taking advantage of falling gasoline prices to squeeze in one last vacation before kids go to school and getting a jump in what could be the largest travel period in five-years. >> from virginia heading back home and possibly over labor day we would like to go away. the kids will be going back to school, so. >> gas prices are a concern but you save up for that over the year as you go along. unless they go way over the top, like over 4.50, $5 we may change plans. >> i don't think it stops me from taking a trip, to tell you the truth. if i'm going on vacation, i go. >> reporter: 34 million americans will travel at least 50 miles away from home over labor day according to aa.

6:54 pm

29 million, 85% will travel by automobile. with the average round trip covering under 600 miles and consumer spending about $800. aaa says it's not just cheaper gasoline prices that has more americans planning to hit the road but growing optimism about the economy and housing. >> americans are feeling more optimistic about their personal financial future. unemployment numbers improved. consumer sentiment and spending are improving, as well as those housing prices. and that's making them feel confident they can take a last summer vacation. >> reporter: a big come back from the recession, back in 2009, aaa says there was a 30% decline in labor day travel. for "nightly business report," i'm hampton pearson in washington. and finally tonight, you may never get rich working for the federal government but may be

6:55 pm

surprised with the net worth. a run down of the welt thoughest lawmakers. in third place, senator mark warner a democrat from virginia worth more than $88 million, he ran a technology company. michael mccaul whose inlaws run the clear channel communications come pan hee and he's worth $101 million. temperatu topping the list the republican chairman of the house oversight and government reform committee worth $355 million. mostly from his viper car alarm business. and send us a stock that you'd like our market monitor guest to discuss on friday. log on to our website nbr.com. click on the link to submit your question and don't forget to tell us where you're from. and that's "nightly business report" for tonight, i'm susie gharib thanks for watching. >> i'm tyler mathisen. thanks from me, as well.

6:56 pm

have a great evening, everyone. see you back here tomorrow night. "nightly business report" has been brought to you by. >> sailing through the heart of historic cities and landscapes on a river, you get close to iconic landmarks, to local life, to cultural treasures. viking river cruises, exploring the world in comfort.

7:00 pm

>> one of the good things and bad things about basic research is you don't necessarily have a plan for what you're trying to do. dr. rick was the fist employee of microsoft research. he's run the lab for more than 20 years. the impact of his work and leadership as been felt throughout the world. rick shared his revolutionaries insights.

186 Views

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11